Asset Workflows

For Accountants & Bookkeepers

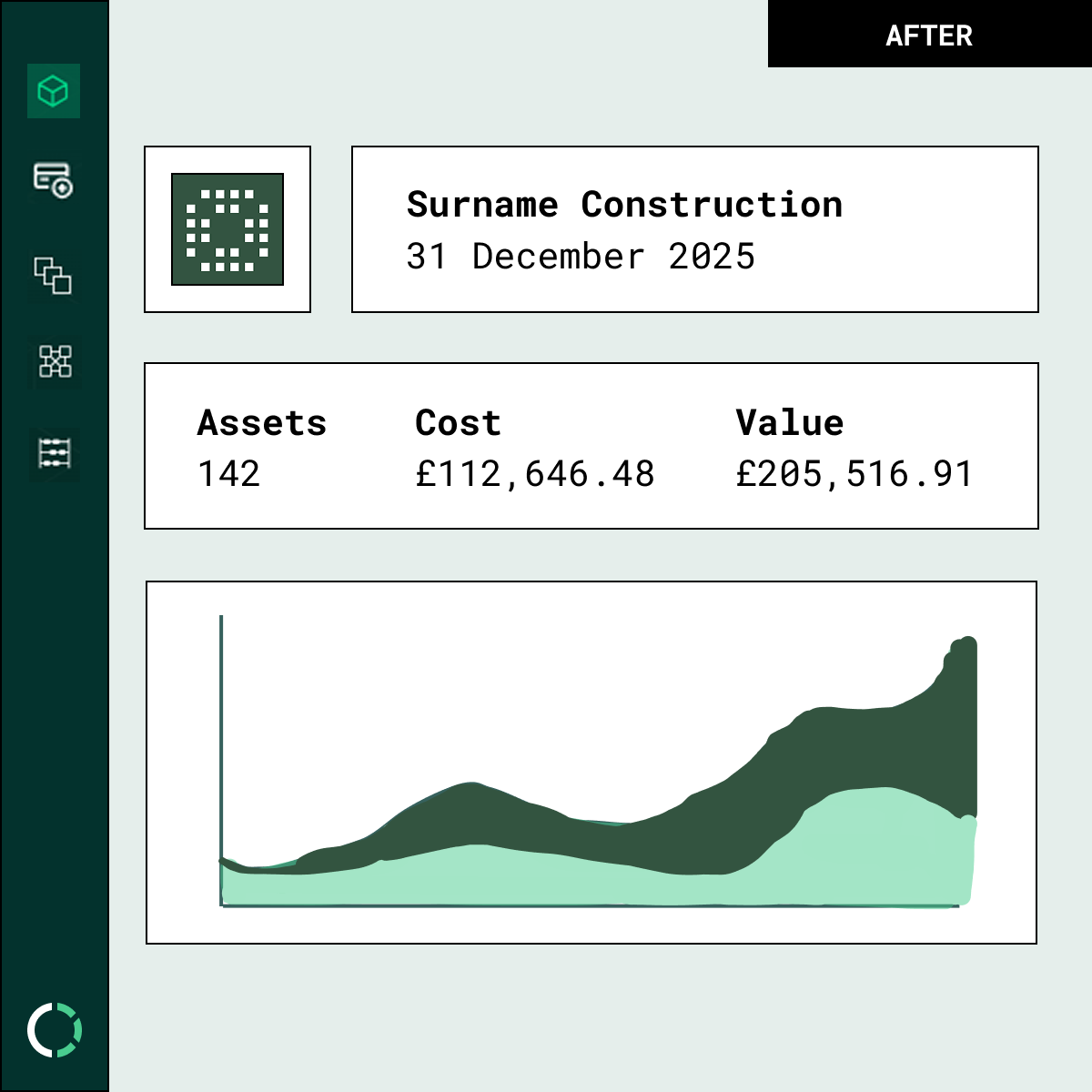

Remove manual rollovers and deliver professional, automated asset registers with unique business monitoring all synced with your accounting system.

Register

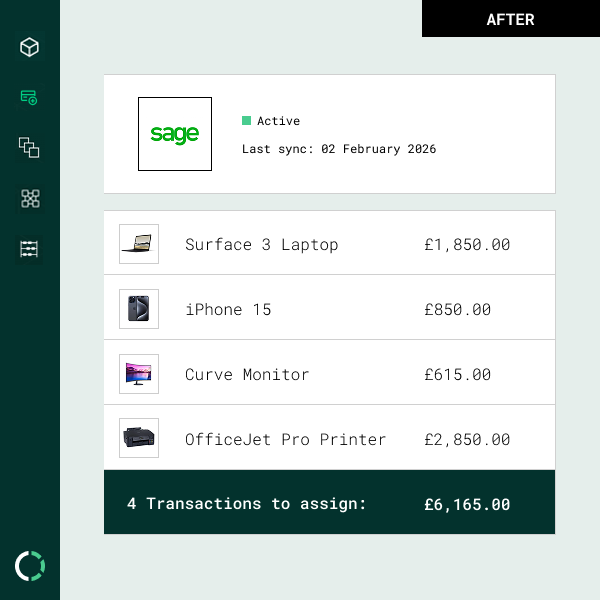

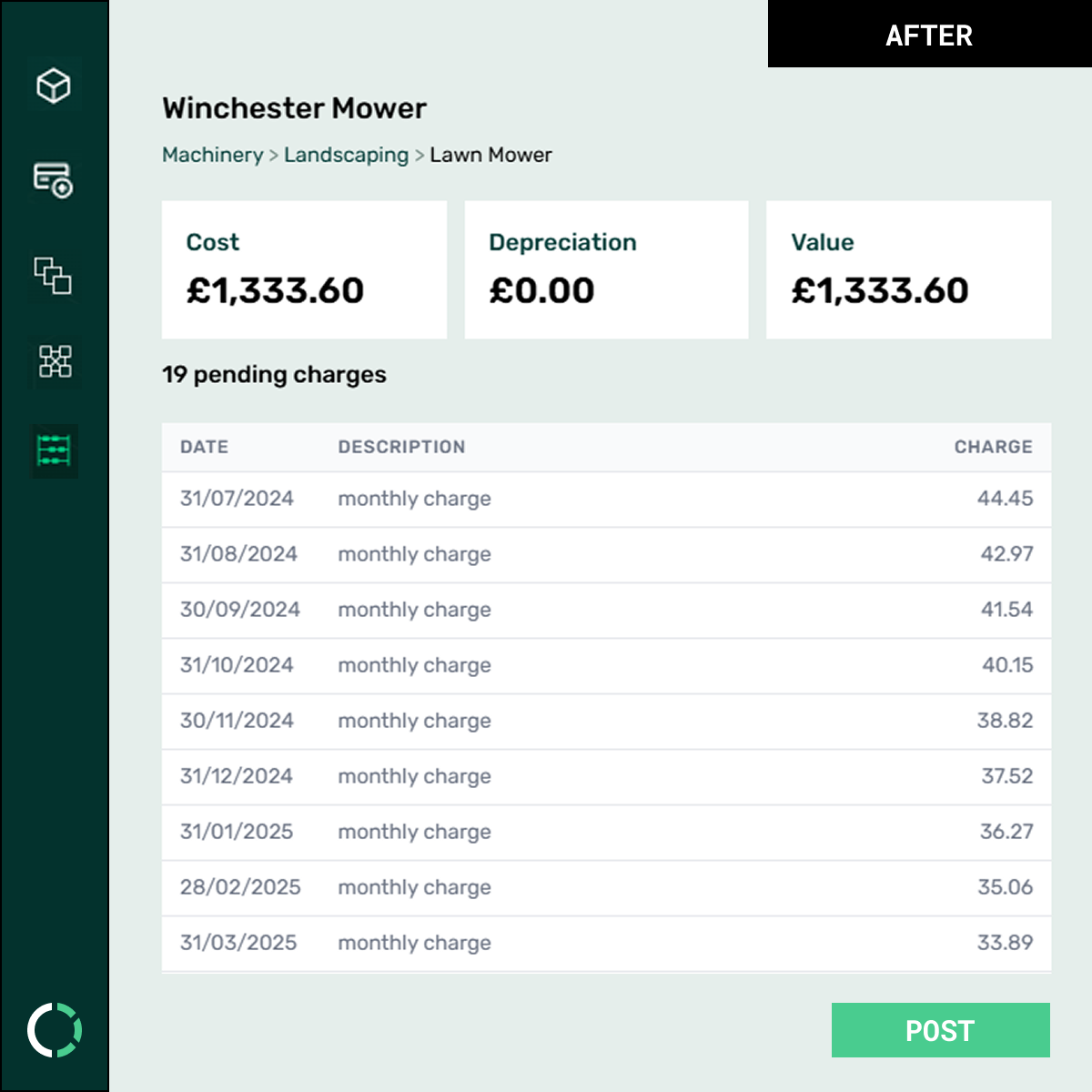

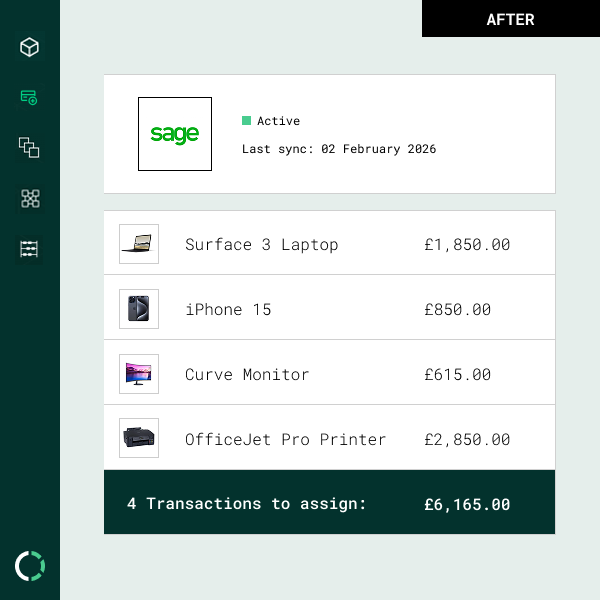

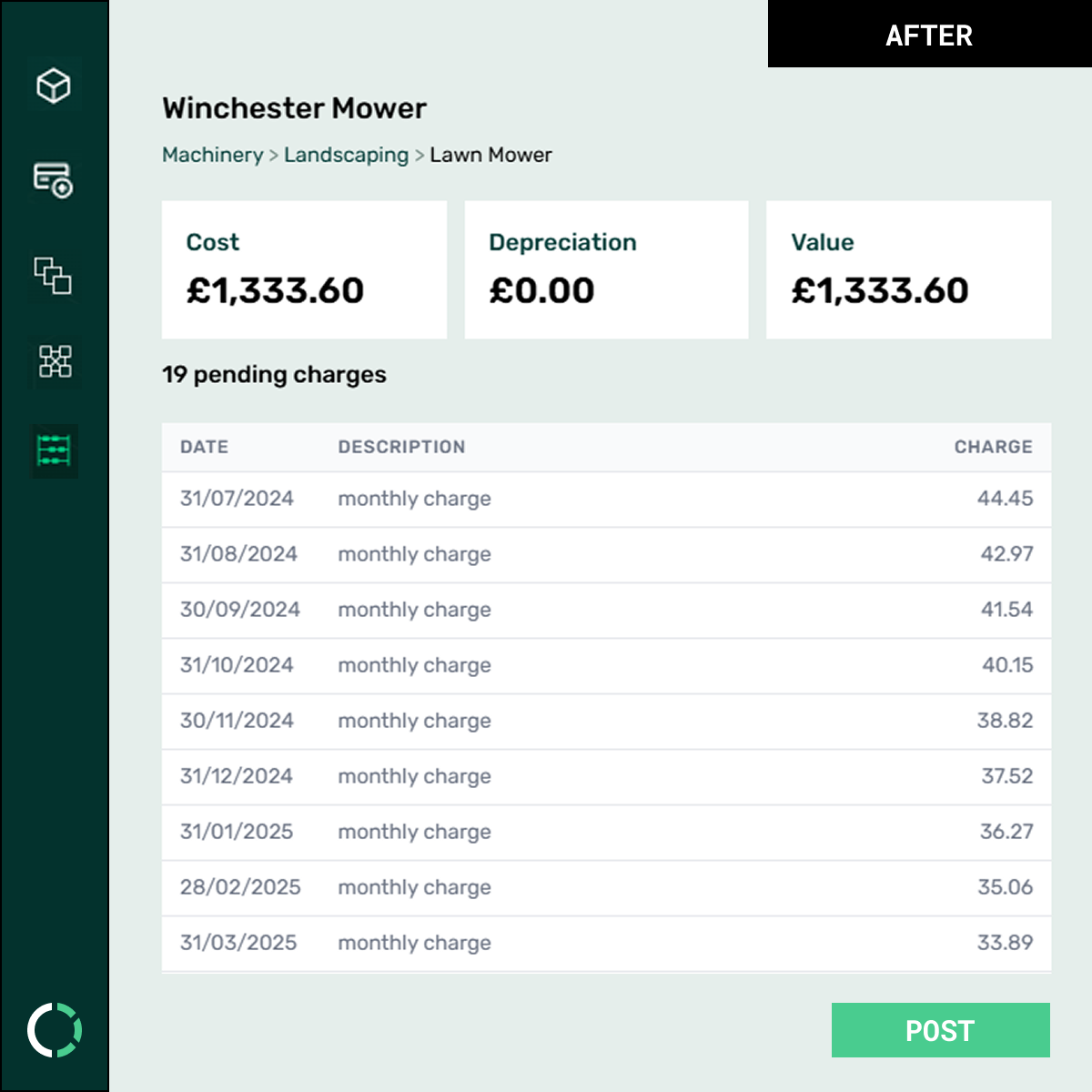

Transactions

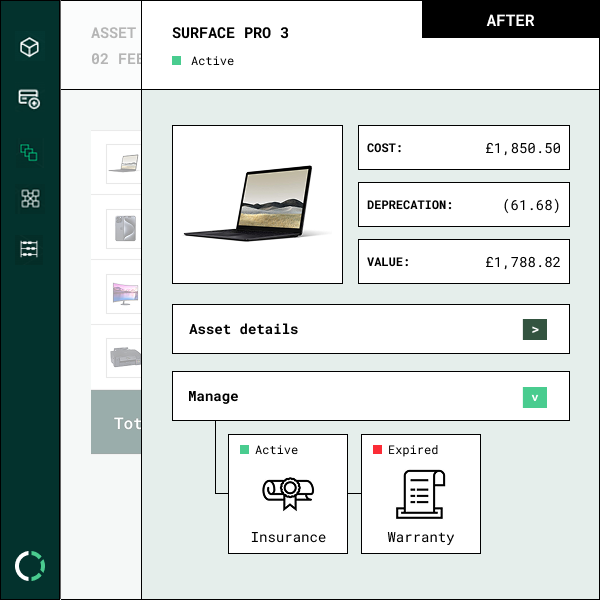

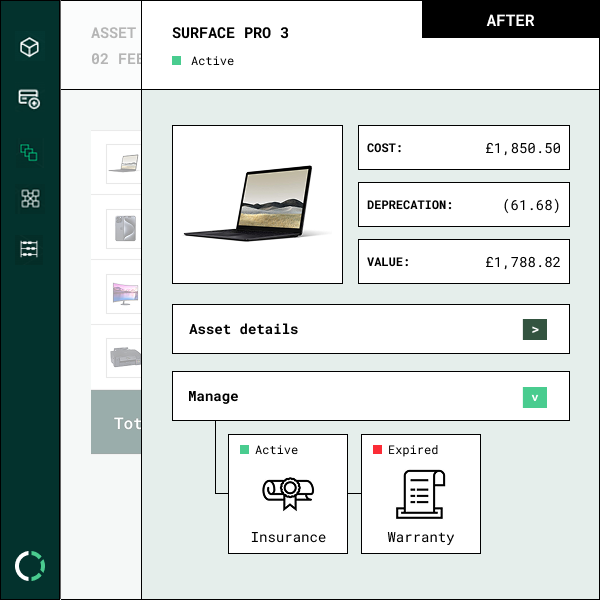

Assets

Accounting

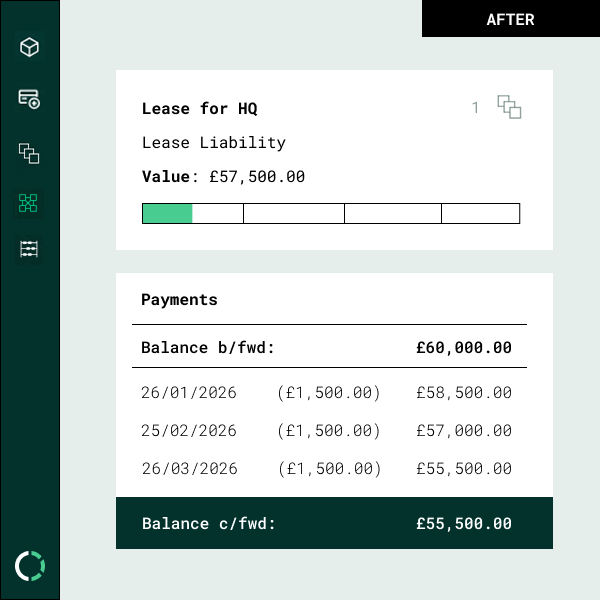

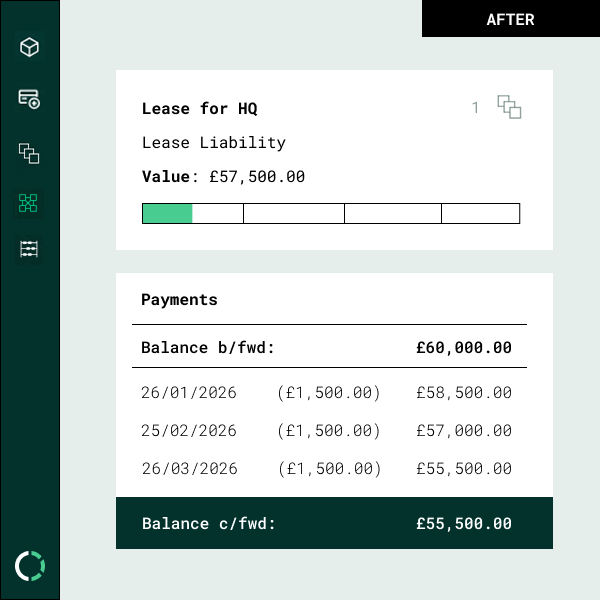

Leases

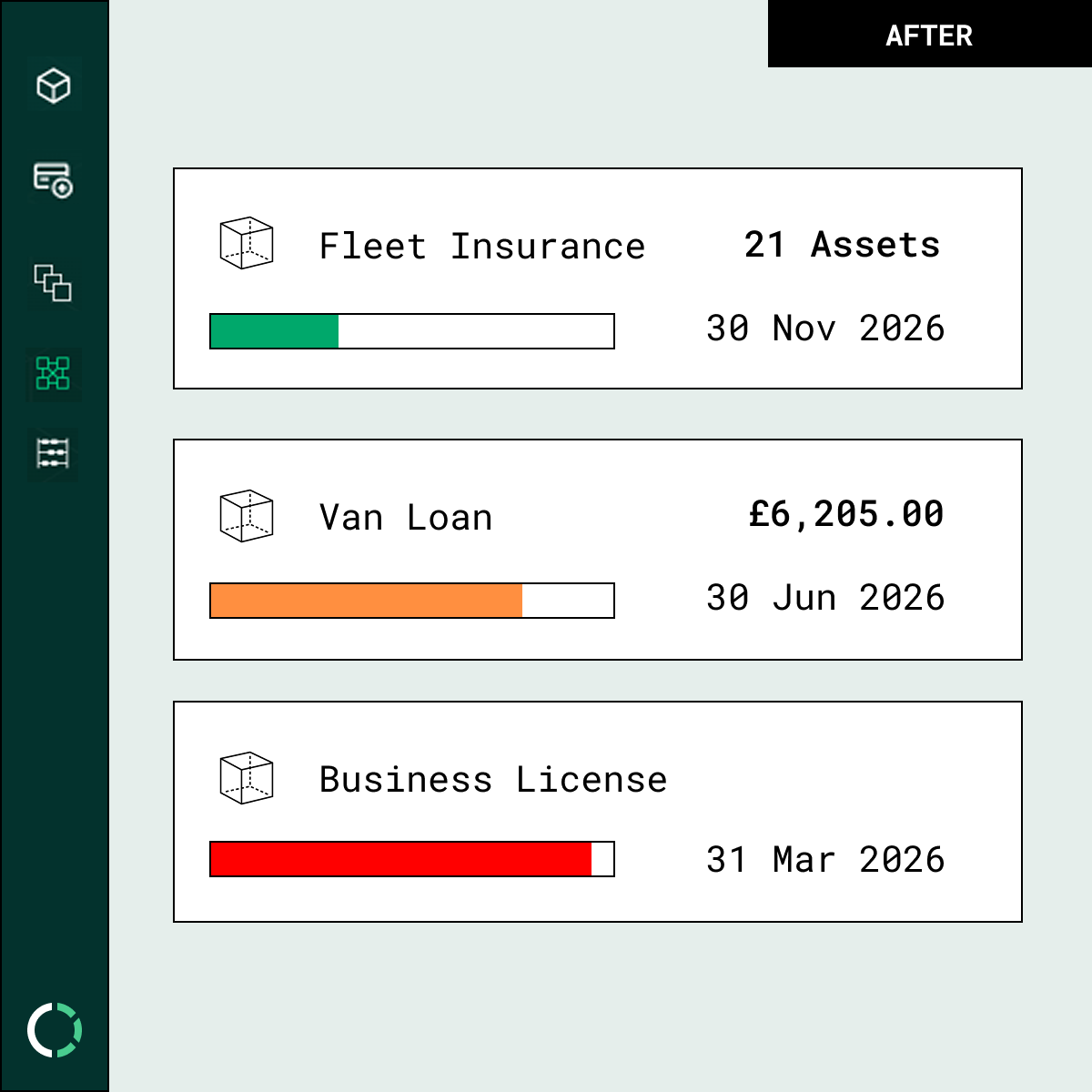

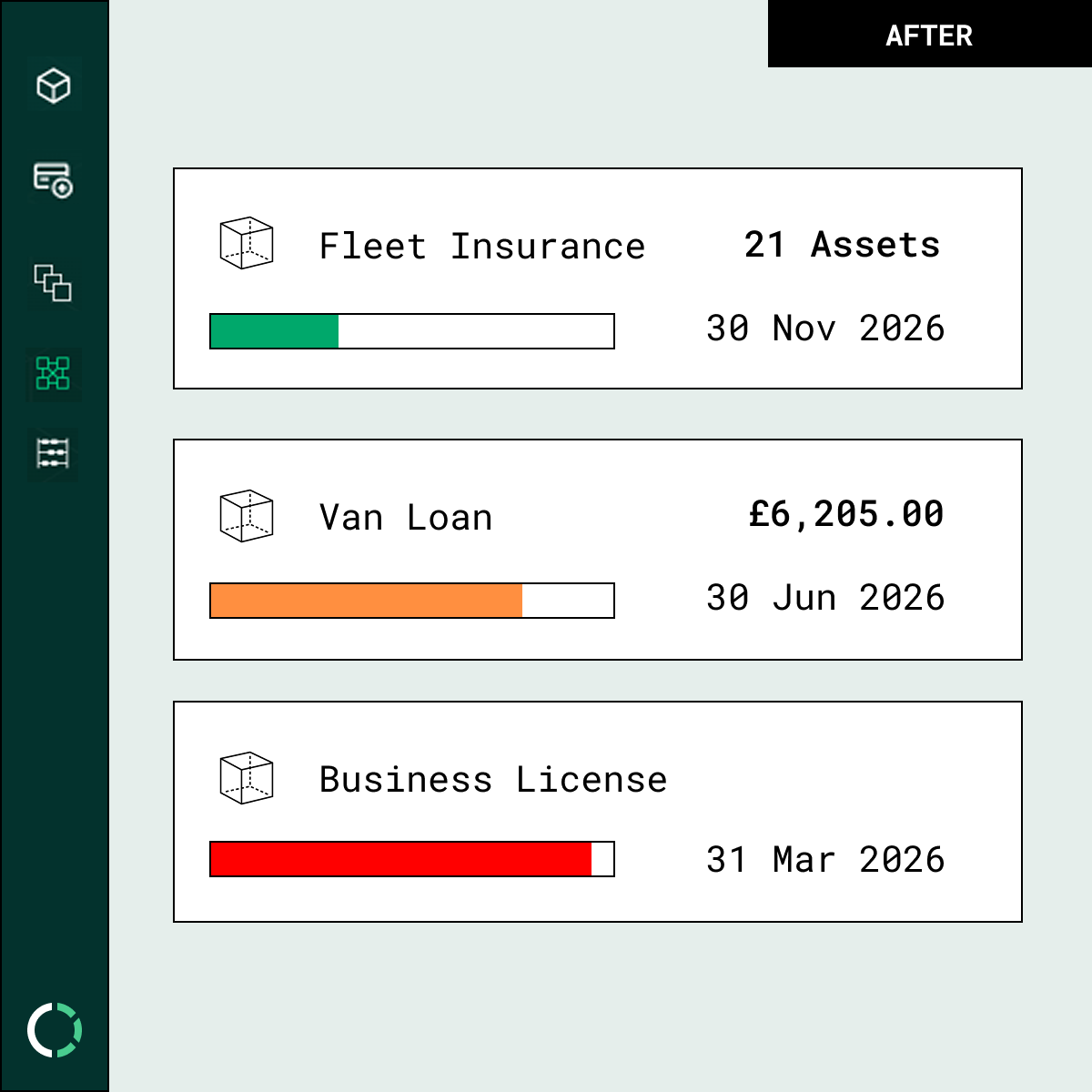

Manage

From manual asset tracking

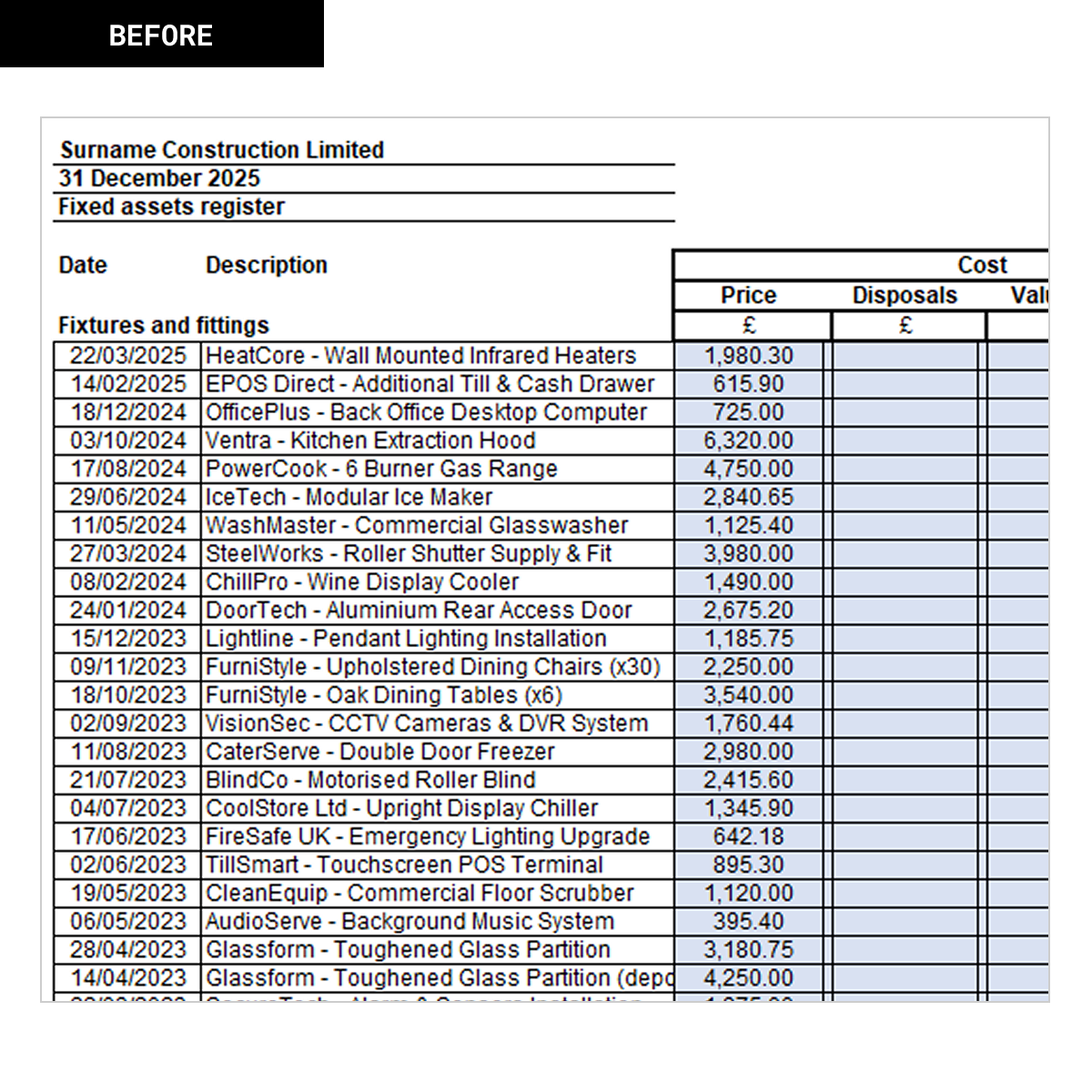

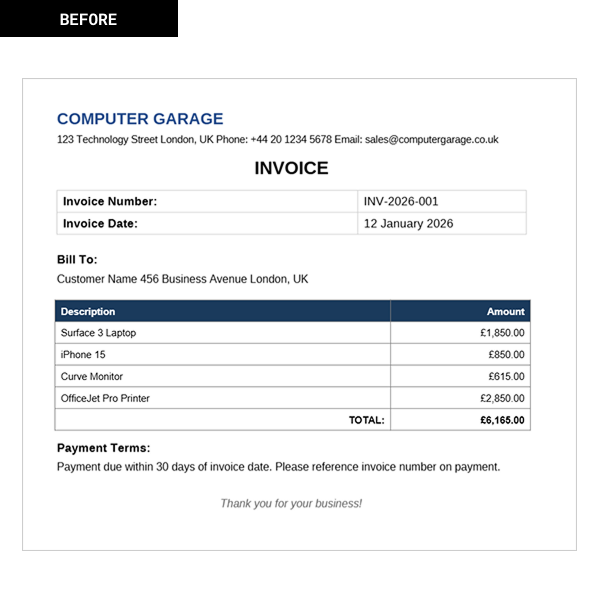

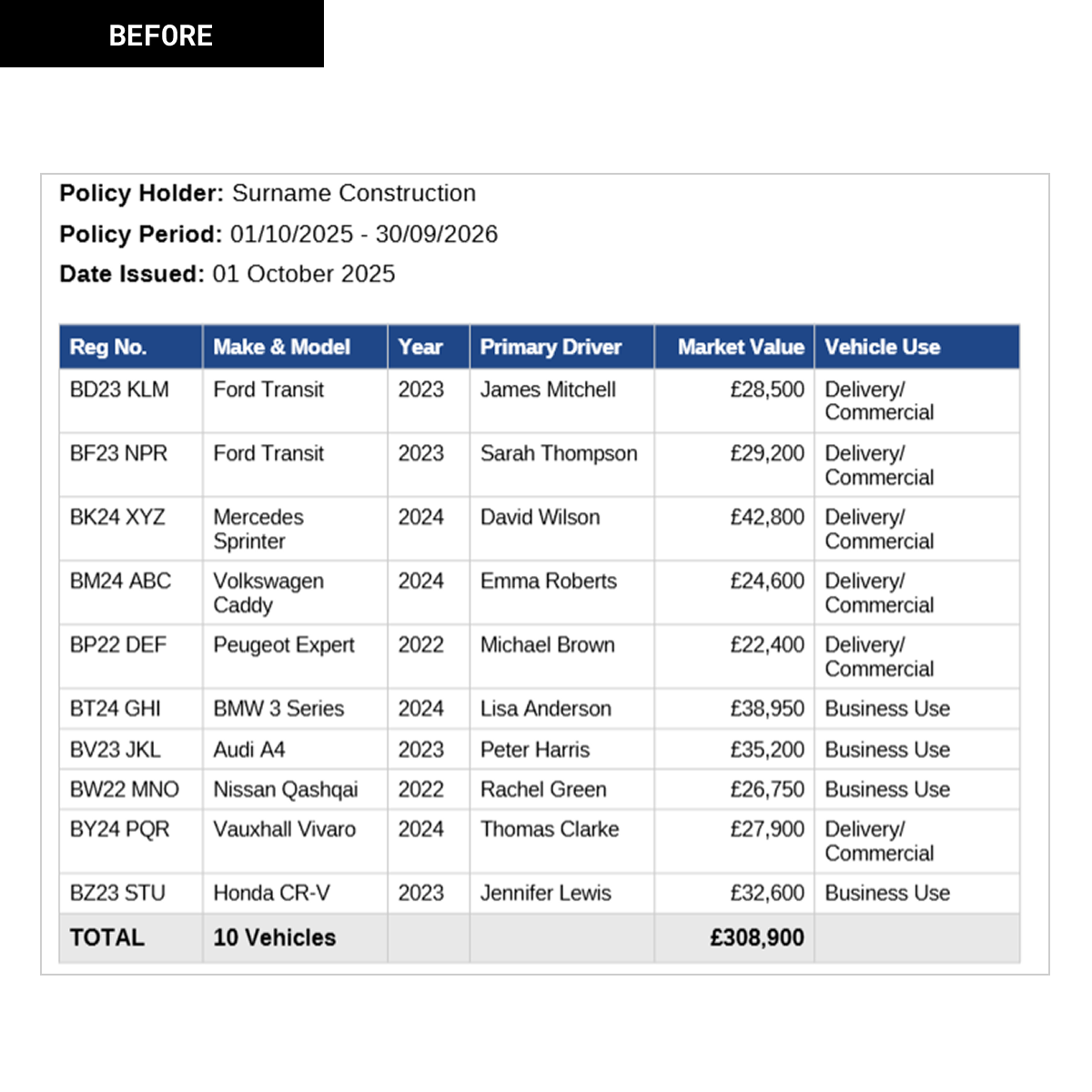

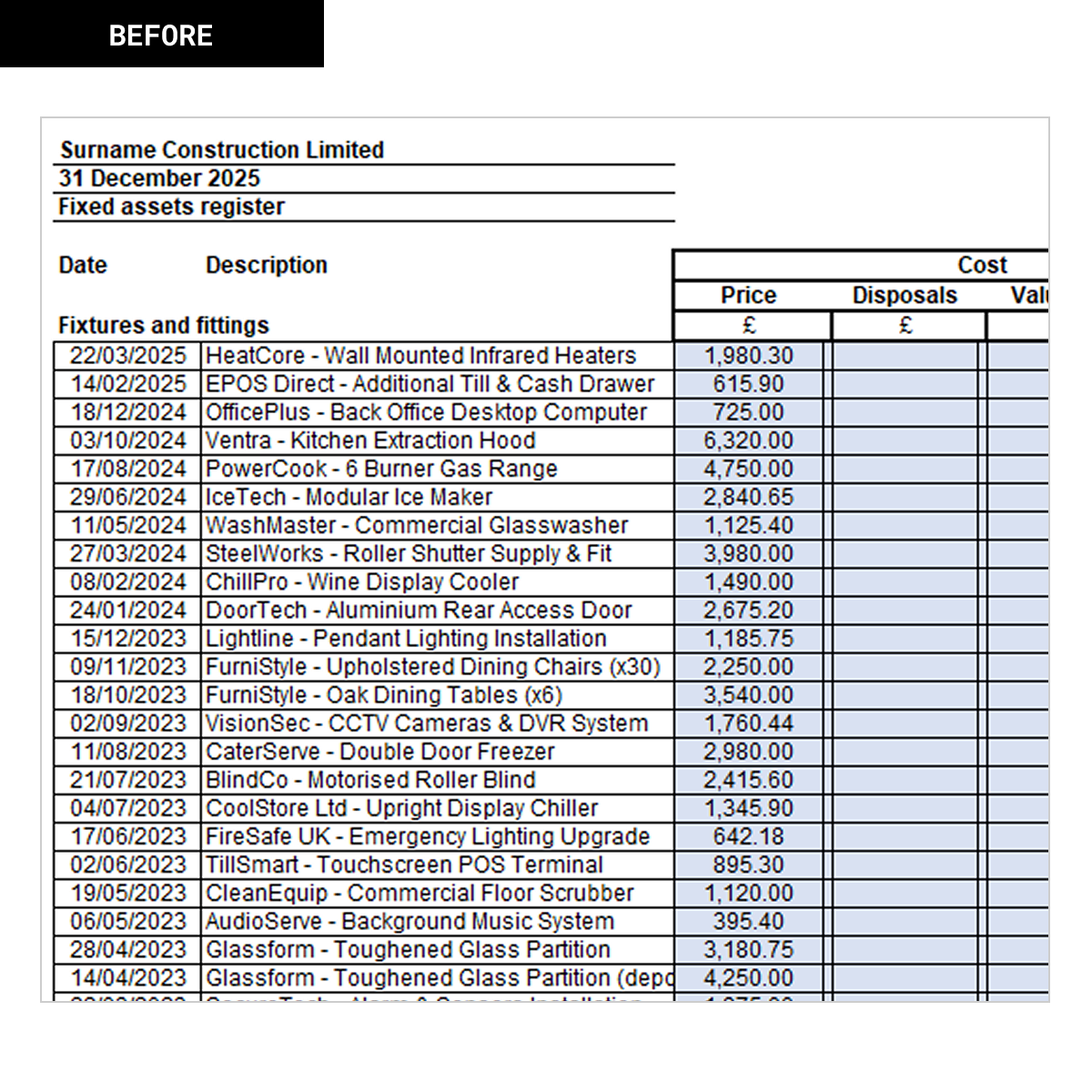

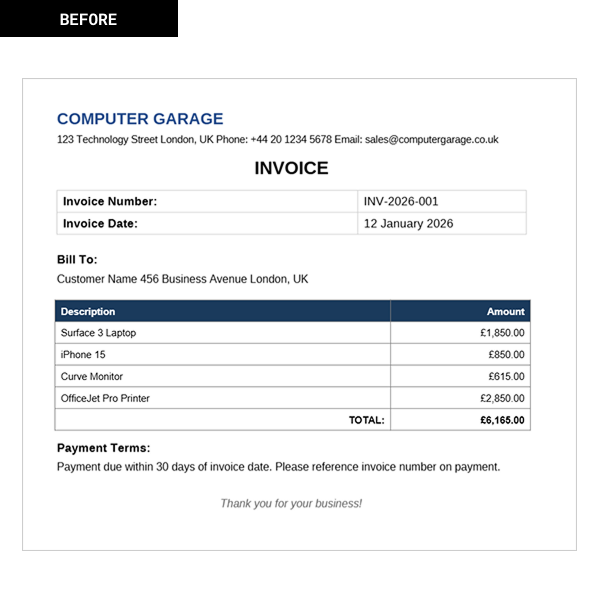

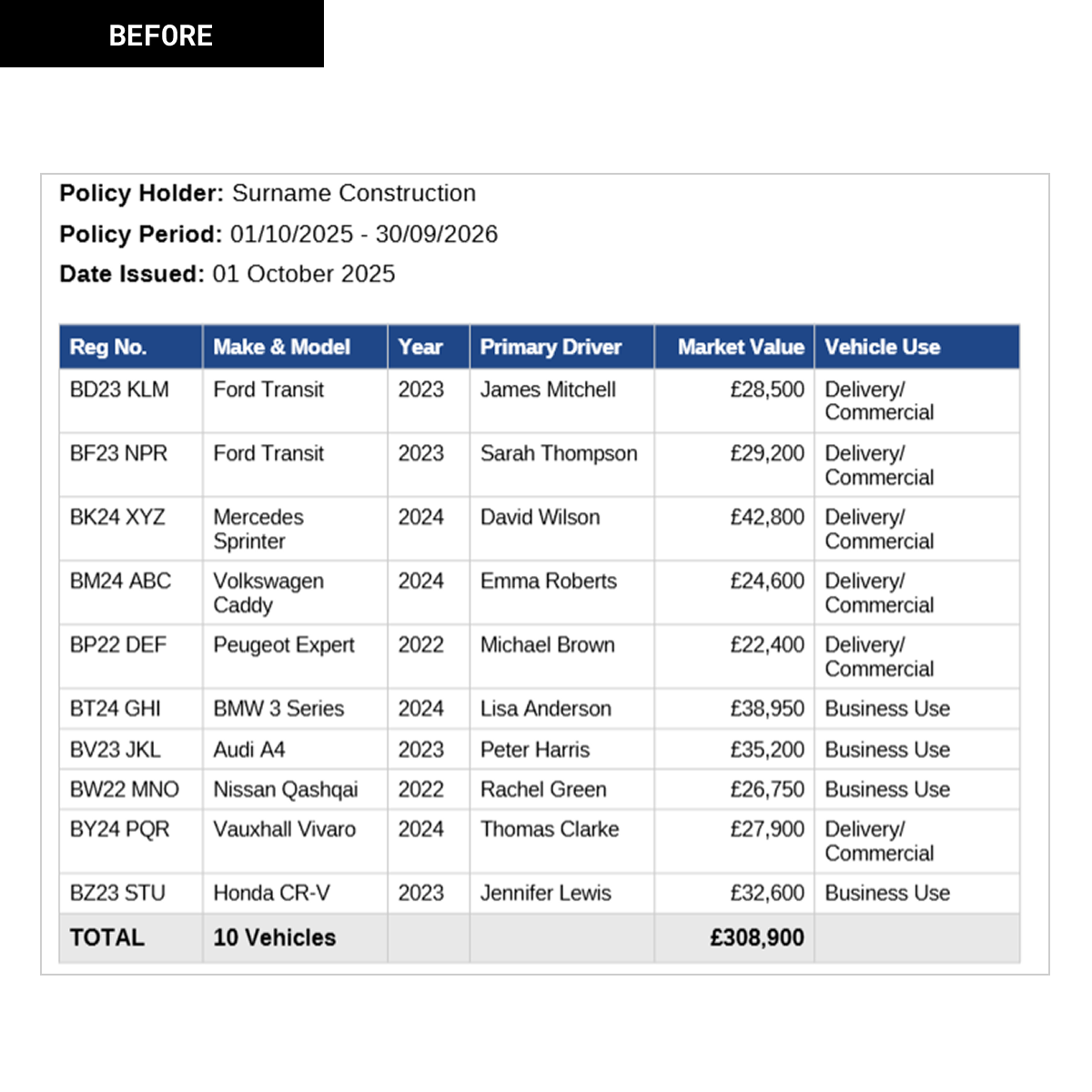

Scattered purchase records

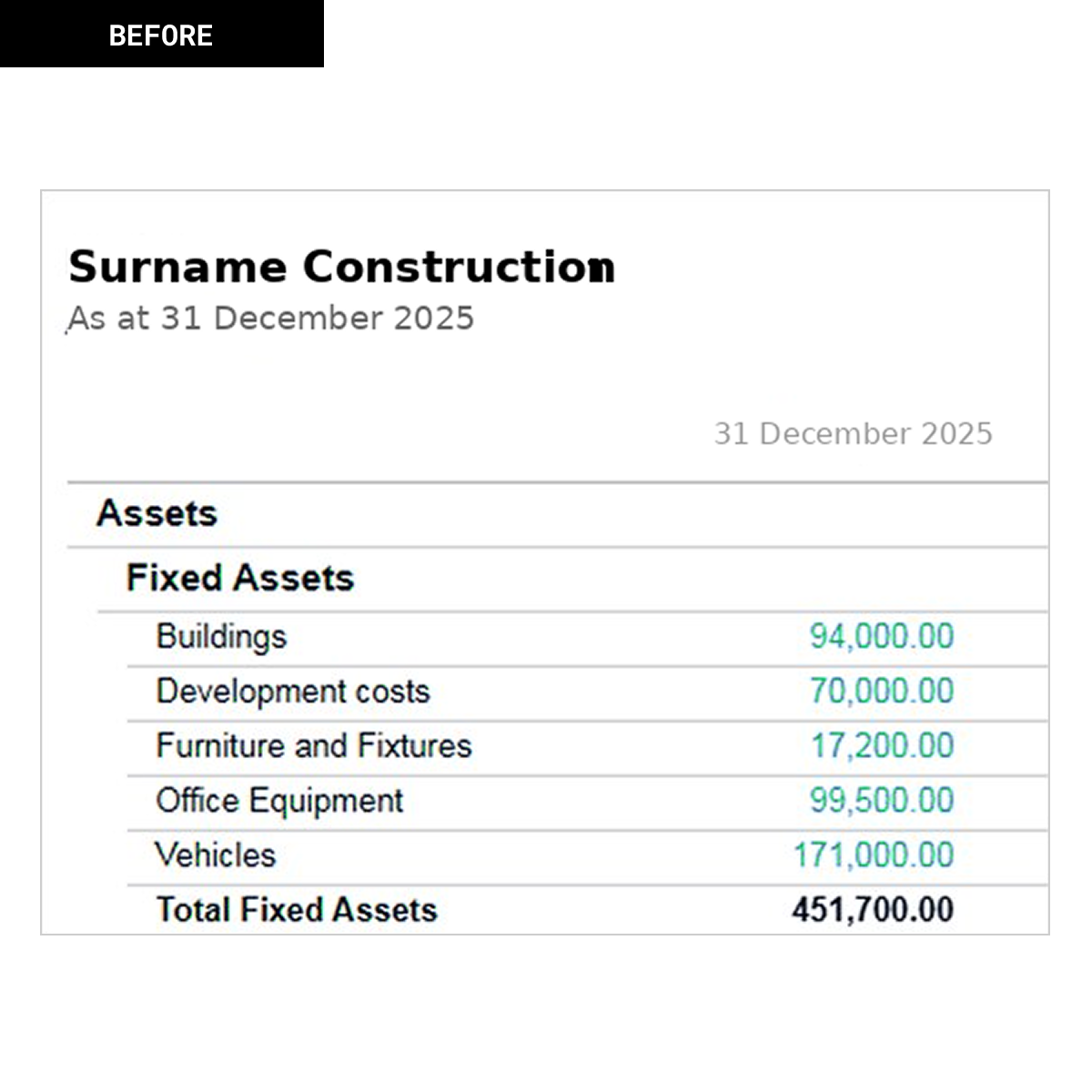

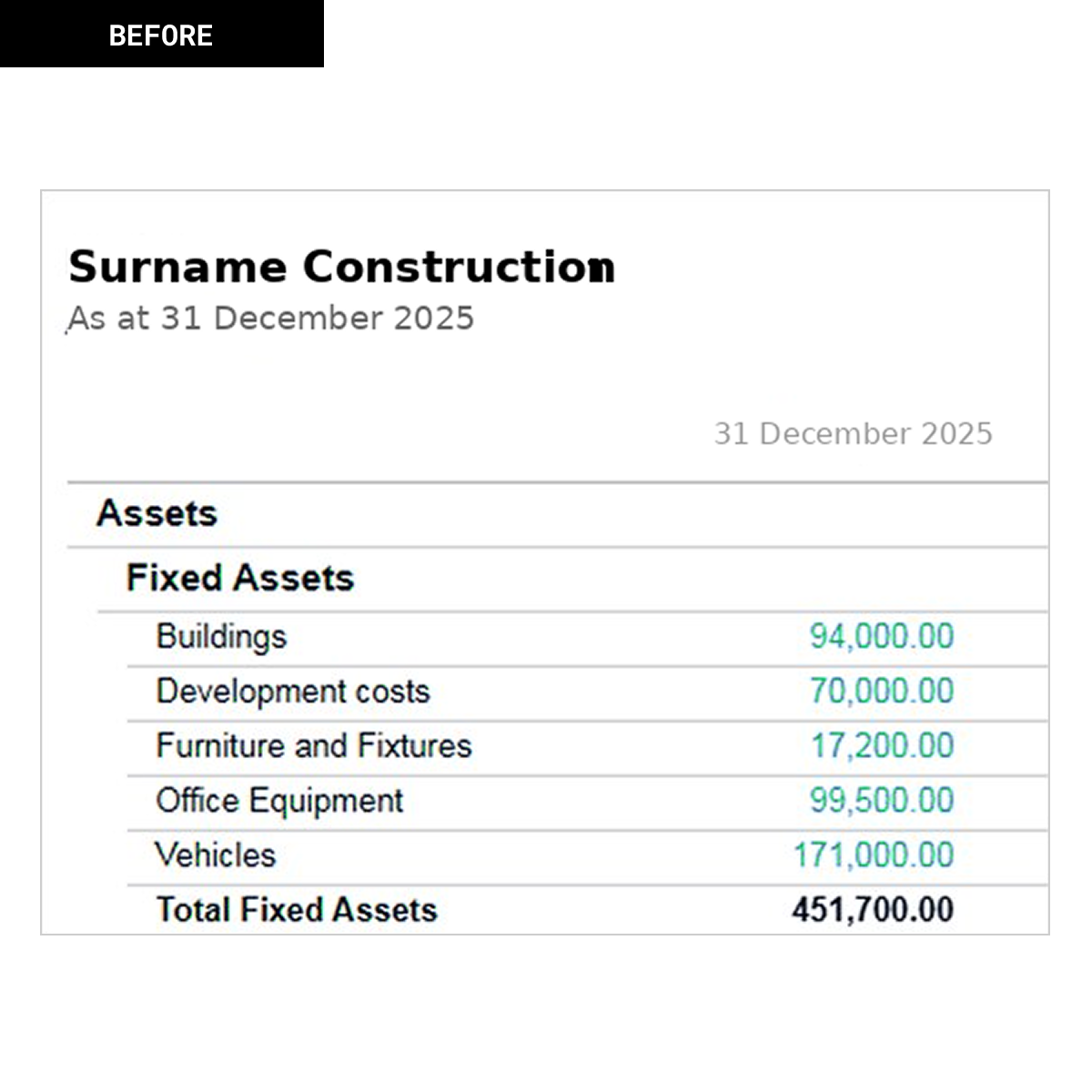

Static asset records

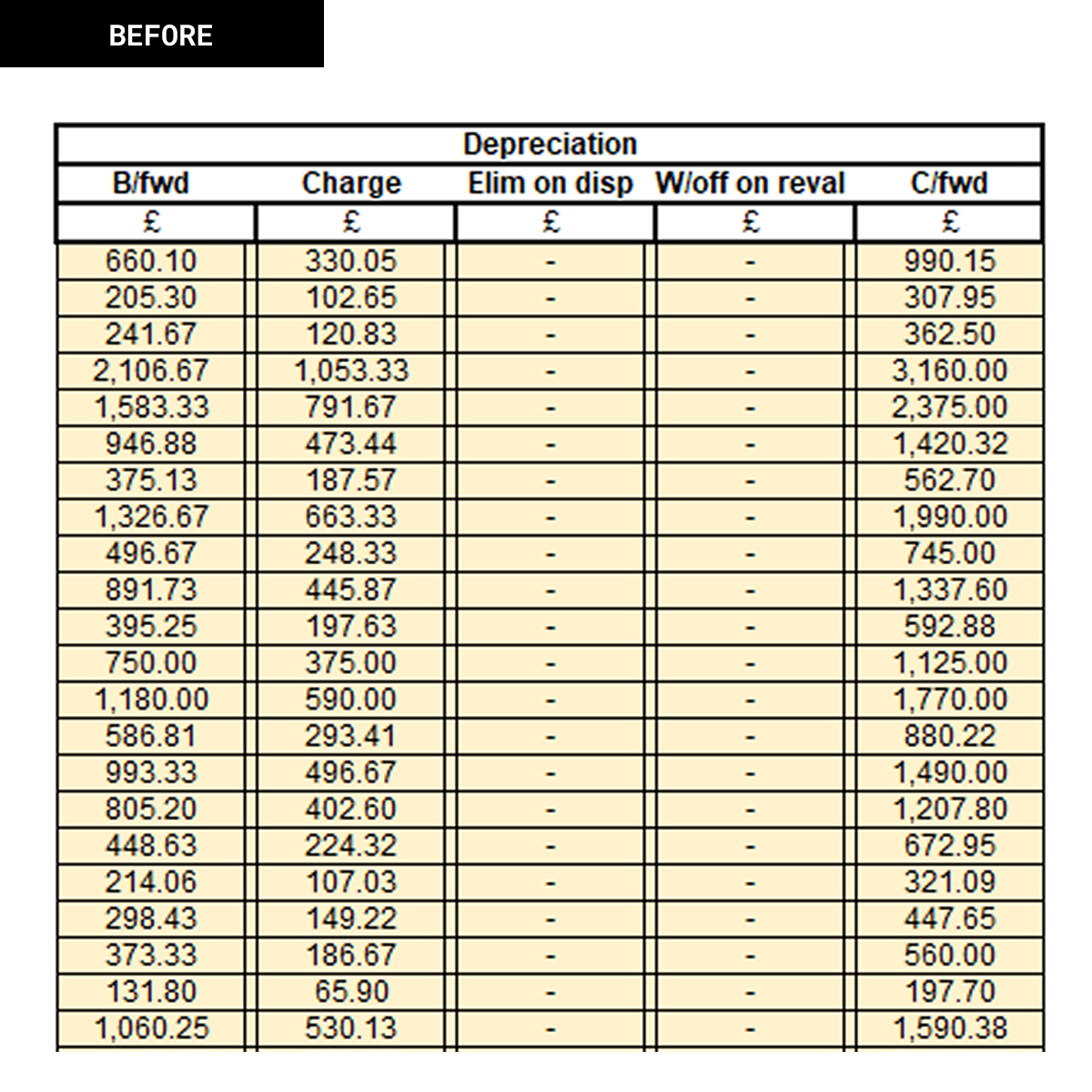

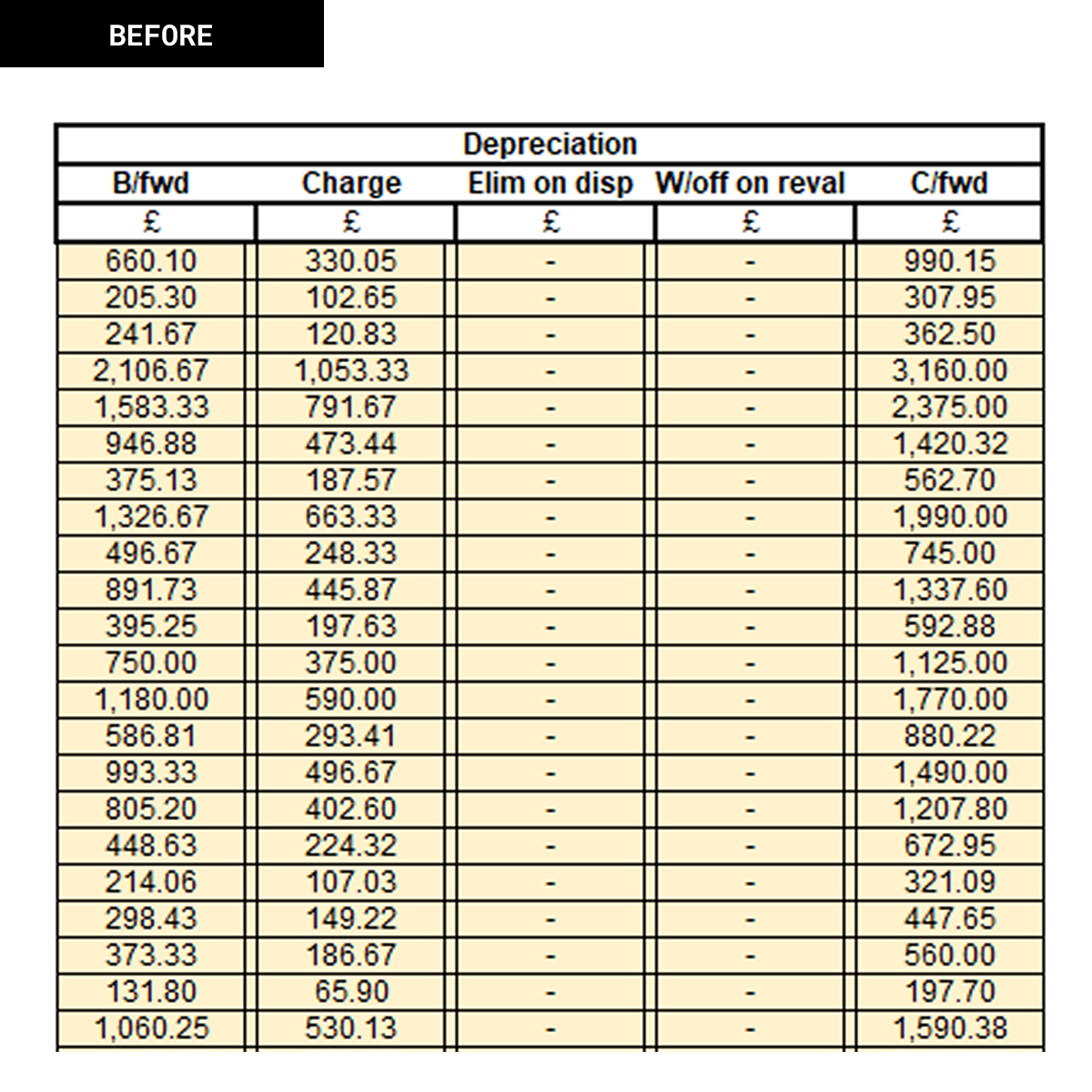

Manual depreciation calculations

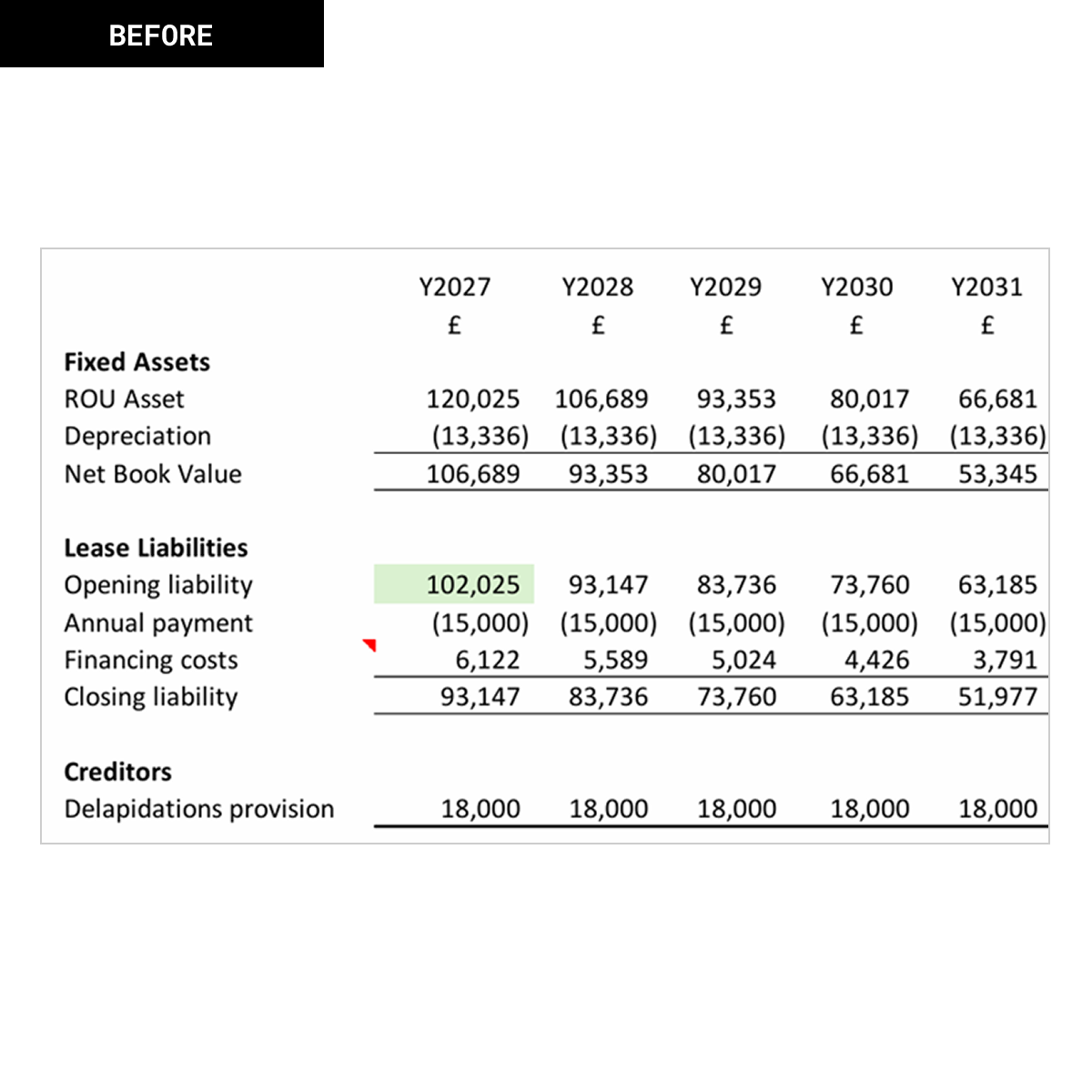

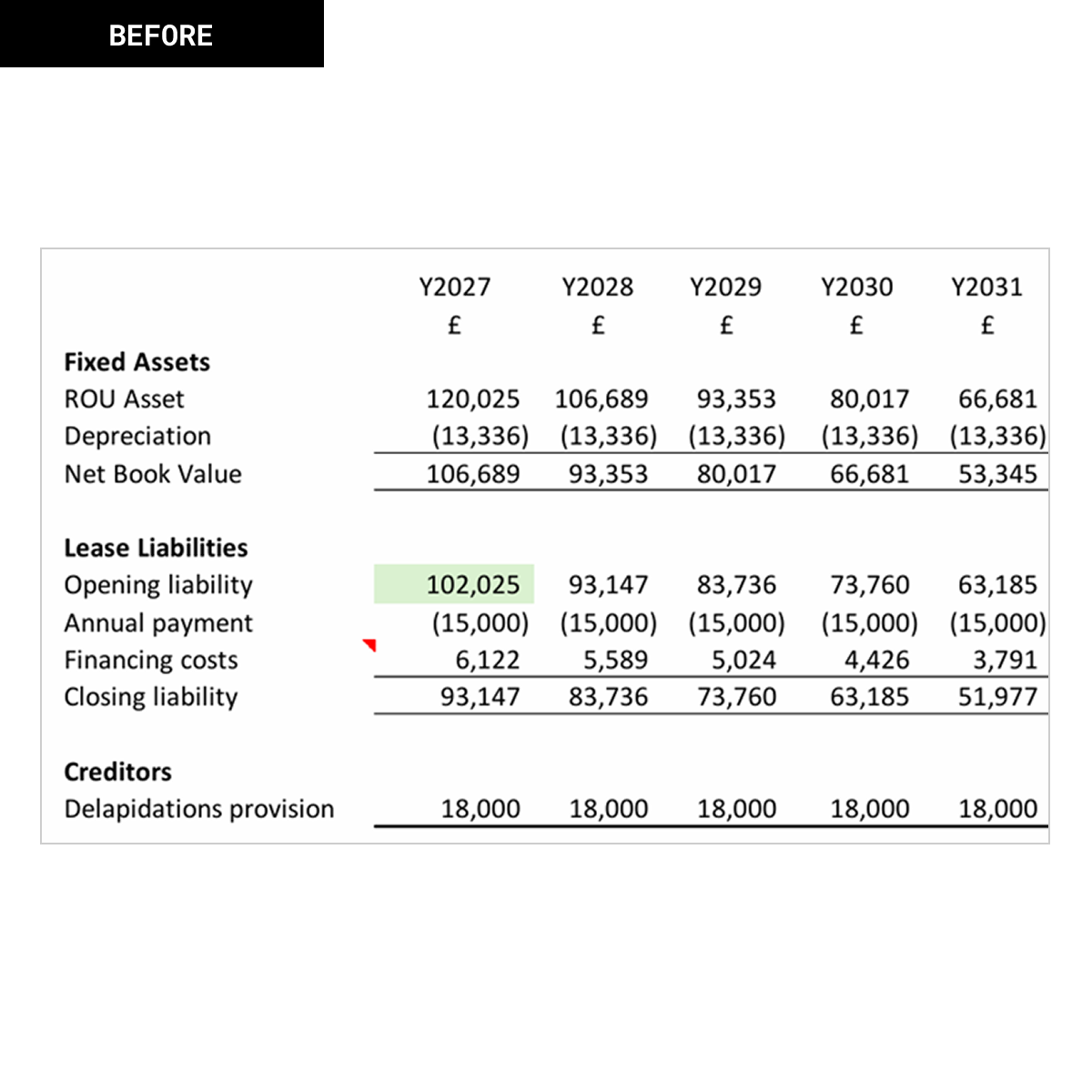

Complex lease calculations

Fragmented document management

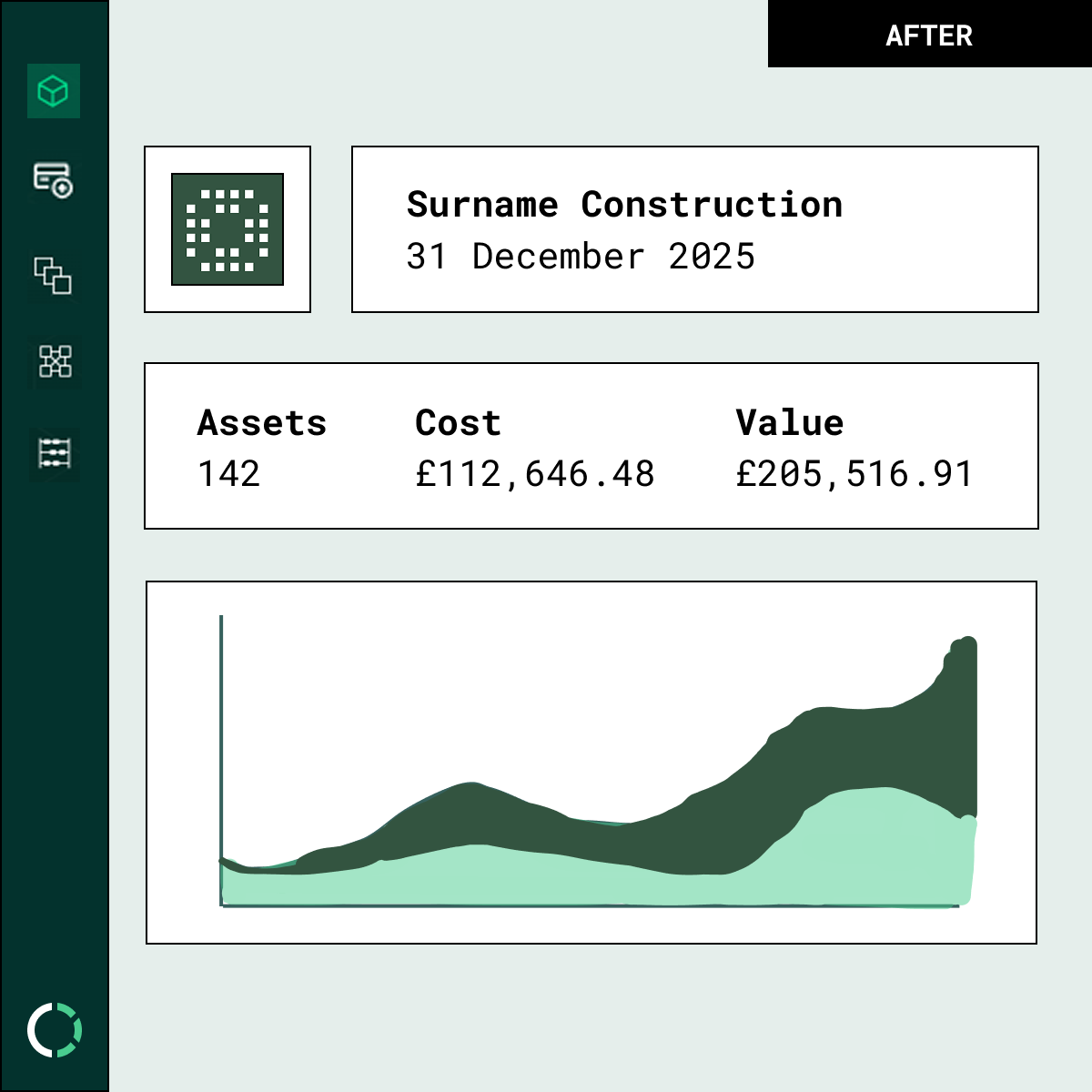

To complete asset visibility

To capturing every purchase

To detailing every asset

To automated depreciation journals

To right of use lifecycle management

All the paper work in one place

From manual asset tracking

Scattered purchase records

Static asset records

Manual depreciation calculations

Complex lease calculations

Fragmented document management

Register

Transactions

Assets

Accounting

Leases

Manage

To complete asset visibility

To capturing every purchase

To detailing every asset

To automated depreciation journals

To right of use lifecycle management

All the paper work in one place

The Feedback so far

I promise you this is worth your time.

We were lucky enough to be one of circlr’s test users and despite me not giving them nearly as much of my time as I wanted Circlr is already making a difference at our firm and as soon as I pull my finger out and get to the end of the to do list it’ll be EPIC. And the raccoons are nice too.

17/10 recommendation; book a call ASAP if you have any fixed assets at all anywhere.

We were lucky enough to be one of circlr’s test users and despite me not giving them nearly as much of my time as I wanted Circlr is already making a difference at our firm and as soon as I pull my finger out and get to the end of the to do list it’ll be EPIC. And the raccoons are nice too.

17/10 recommendation; book a call ASAP if you have any fixed assets at all anywhere.

Sync with the tools

you already use

Get started in minutes with accounting systems used by millions of businesses.

Frequently Asked

Questions

What is the average cost saving?

For a firm managing a minimum of ~20 clients, firms typically save £10k+ per year in admin time by removing spreadsheet roll-forwards, client reviews and manual journal posting. We can calculate your savings on a demo.

Is circlr an accounting system?

No, circlr isn’t another accounting system. It’s a fixed asset workflow system that calculates depreciation, posts journals, captures supporting information, and enables collaboration between firms and clients.

How long does setup take?

Initial setup takes ~10 minutes. Each client Migration depends on your client size and complexity, but most firms are fully onboarded within 2–5 days with a dedicated account manager.