Do Your Own Books?

Get The Full Overview

Of Your Business

Quick, simple, and cost-effective asset tracking, automatically synced with your accounting system.

How it works

Accounting systems store transactions.

Accounting platforms remain the system of record for financial data and the source of truth.

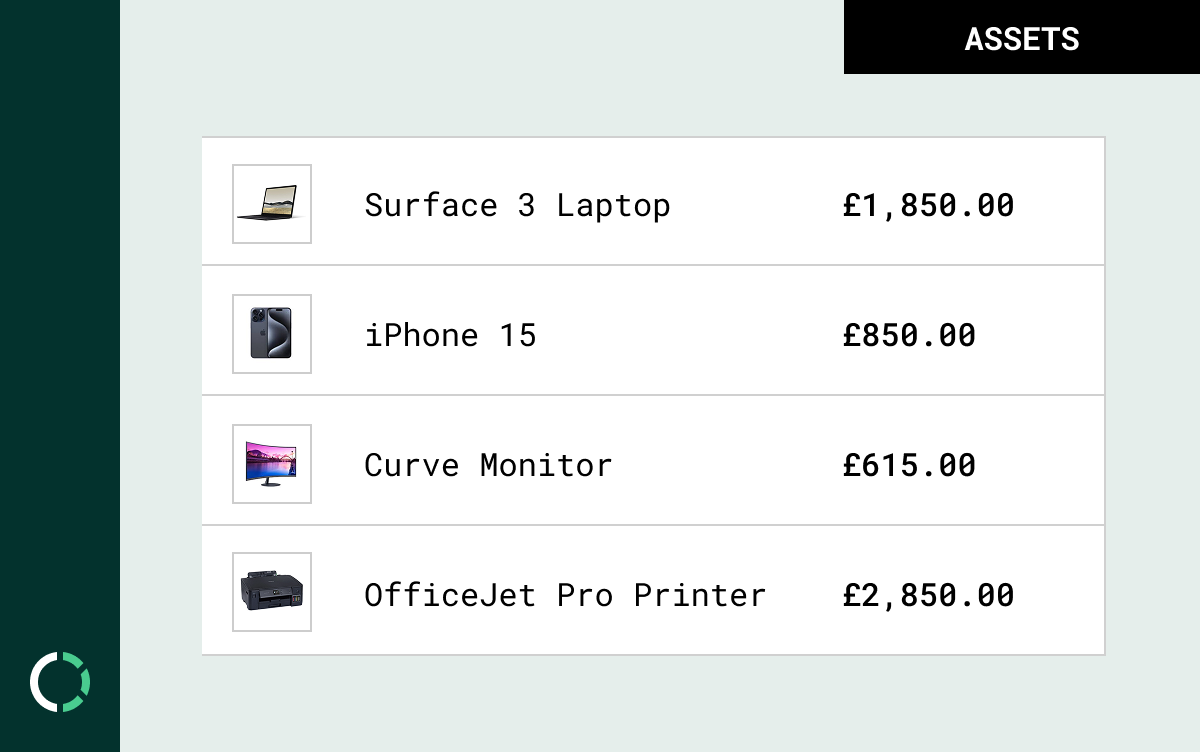

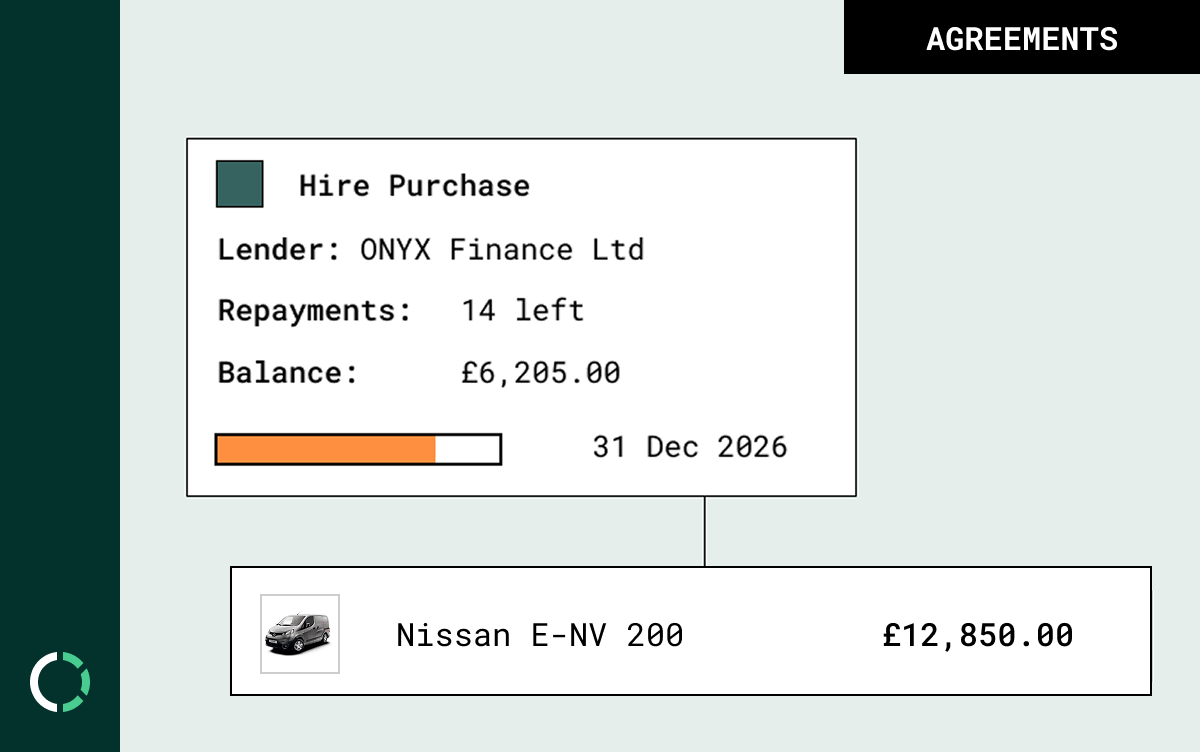

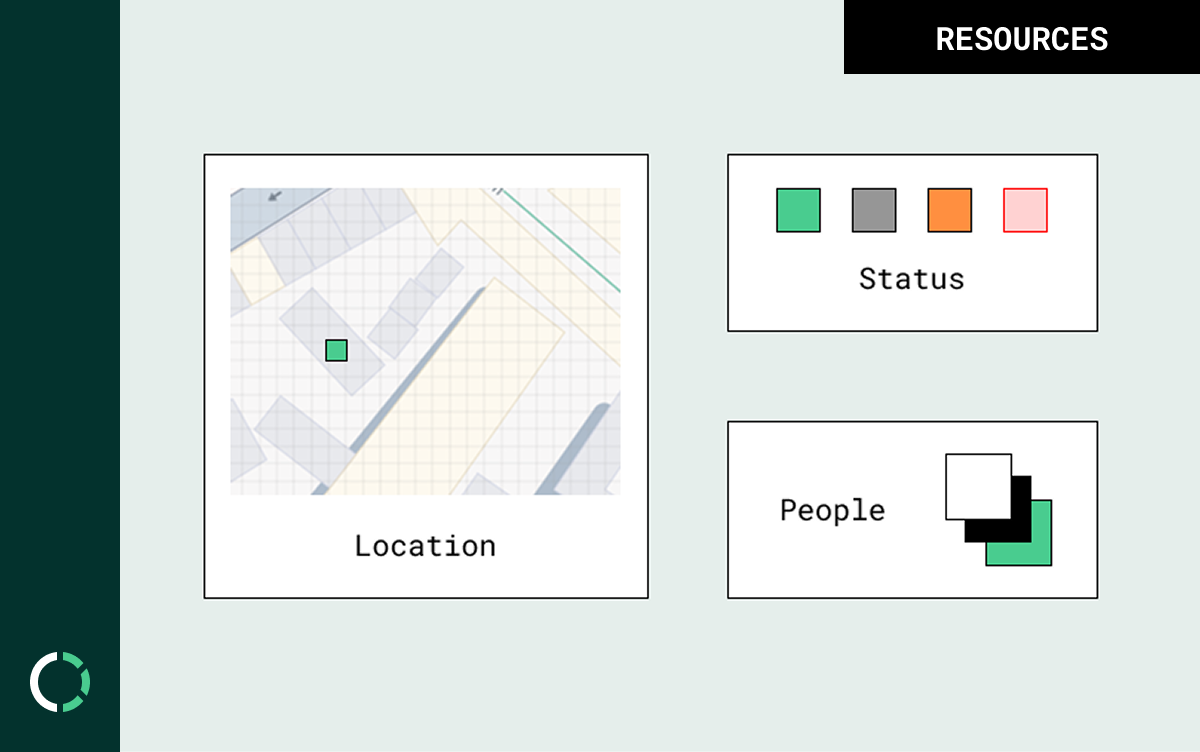

circlr tracks assets and operations.

circlr connects transactions in your accounting system to build assets, how they are used, maintained, insured, financed and retired.

Quick Guide To

Getting Set-Up

Connect

Select and log-in to your accounting system and connect circlr.

1 minute

Sync Ledgers

Import your existing transactions and any excel registers in minutes

2 minute

Add Assets

Merlin, Our step by step guide will walk you through set up.

3 minute

Frequently Asked

Questions

How long does setup take?

Initial setup takes ~5 minutes. Importing your existing register depends on size and complexity, but most businesses are fully onboarded the same day.

Is circlr an accounting system?

No. circlr syncs with your accounting systems general ledger. It’s a fixed asset workflow system that calculates depreciation and generates journals for your accounting platform.

Do I need an accountant to use it?

No. Businesses can run circlr directly if they are familiar with their general ledger and accounting. Accountants can then collaborate when needed.

If you would like support, circlr is happy to assist.

If you would like support, circlr is happy to assist.

Pricing

circlr scales based on your

usage and complexity.

Container

Base: £15 / Month

Includes

300 assets

Agreements

Task management

Manage lease life cycle

Automated depreciation

Audit history

Journal posting

Scale in blocks

Fixed: +£10 / Month

Includes

+100 Assets

Everything in base